Las Vegas Real Estate Prices Reach Unprecedented Heights

Recent analyses reveal that Las Vegas home prices have surged far beyond what conventional economic indicators would justify, positioning the city as the most overvalued housing market in the United States. This divergence between property values and core market fundamentals has sparked concerns about the sustainability of current price levels and the potential for a market correction that could impact affordability for local residents.

Several key dynamics are driving this rapid escalation in home prices:

- Scarcity of available homes leading to intense bidding competitions among buyers

- Heightened activity from real estate investors increasing demand and pushing prices upward

- Strong economic sentiment encouraging speculative buying despite affordability constraints

| Indicator | Las Vegas | U.S. Average |

|---|---|---|

| Price-to-Income Ratio | 9.3 | 6.8 |

| Price-to-Rent Ratio | 24.5 | 18.1 |

| Months of Inventory | 1.2 | 3.5 |

Unpacking the Causes Behind Las Vegas Housing Market Overvaluation

The exceptional rise in Las Vegas property values stems from a blend of economic, demographic, and policy-related factors. The city’s booming population, fueled by job growth in sectors like technology, hospitality, and entertainment, has intensified housing demand. Meanwhile, supply-side limitations-such as slow residential construction rates and stringent zoning regulations-have constrained the availability of new homes, exacerbating price pressures.

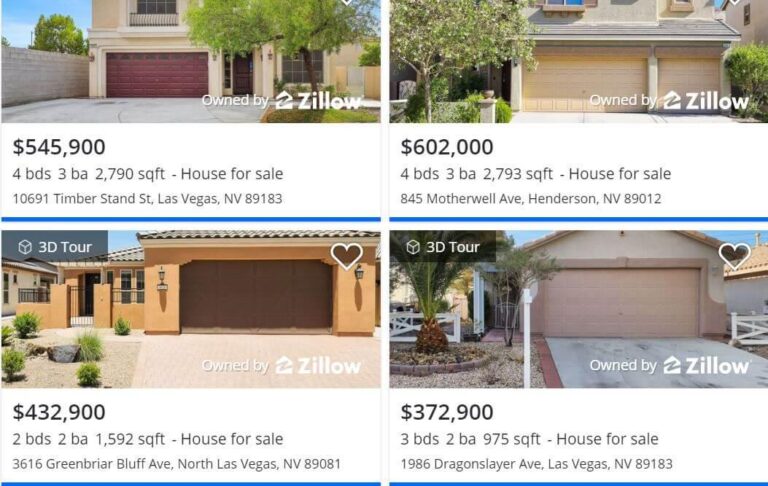

Investor participation has also surged, with many purchasing properties for flipping or rental purposes, further tightening the market. Additionally, the prolonged period of historically low interest rates has enhanced buyers’ purchasing power, encouraging more aggressive bidding despite affordability challenges. Las Vegas’s appeal as a tax-friendly destination and entertainment capital continues to attract affluent buyers, driving demand for both luxury and mid-tier housing.

Key contributors to this overvaluation include:

- Population influx: Steady migration driven by expanding employment opportunities.

- Housing supply bottlenecks: Limited new construction and restrictive land-use policies.

- Investor demand: Increased acquisition of properties for investment purposes.

- Speculative purchasing: Buyers motivated by expectations of ongoing price increases rather than long-term residency.

| Factor | Market Effect | Current Trend |

|---|---|---|

| Population Growth | Elevated housing demand | Rising |

| Supply Constraints | Reduced housing availability | Persistent |

| Investor Purchases | Price inflation | Increasing |

| Low Interest Rates | Enhanced buyer leverage | Recently shifting upward |

Financial Consequences for Las Vegas Homebuyers and Sellers

For buyers, the inflated housing prices translate into substantial financial challenges.Elevated property costs mean larger mortgage loans, which increase monthly payments and strain household budgets. This environment notably disadvantages first-time buyers, many of whom find themselves priced out of the market, thereby increasing demand for rental properties.

Moreover, the risk of negative equity looms if home values decline, leaving owners owing more than their properties are worth and complicating refinancing or resale efforts.

On the seller side, rapid price recognition offers opportunities for critically important short-term profits. However, these gains come with risks, including exposure to market volatility and the possibility of price stagnation or declines. Sellers may also face challenges if inflated price expectations deter potential buyers, resulting in longer listing periods or the need to reduce asking prices.

| Participant | Immediate Outcome | Potential Risk |

|---|---|---|

| Buyers | Increased borrowing costs | Market corrections,negative equity |

| Sellers | Profitable sales | Market downturns,prolonged listings |

Effective Approaches to Buying in Las Vegas’s Overheated Market

Given the current overvaluation in Las Vegas real estate,prospective buyers need to employ strategic methods to successfully navigate the competitive landscape. Securing pre-approved financing can demonstrate financial readiness and strengthen negotiating positions in bidding wars. Expanding the search to emerging neighborhoods or suburbs may reveal more affordable options with promising growth potential.

Additionally, considering properties that require some renovation-often referred to as fixer-uppers-can offer opportunities to customize a home while avoiding the premium prices of turnkey properties. Staying well-informed about market trends and maintaining versatility on non-essential criteria can help buyers act decisively when favorable opportunities arise.

Partnering with informed local real estate agents is invaluable, as they often have access to off-market listings and can provide insights into pricing dynamics.Above all, patience and disciplined budgeting remain critical to making sound purchasing decisions in this volatile market.

Conclusion: Outlook for the Las Vegas Housing Market

As Las Vegas continues to experience one of the nation’s most inflated housing markets, experts urge caution among buyers and investors. With home prices significantly outstripping income growth and rental returns, the risk of a market correction is a pressing concern.Stakeholders should closely monitor economic indicators and market signals in the coming months. For now, Las Vegas remains a focal point in national discussions about housing affordability and market sustainability.