Las Vegas Housing Market Experiences Unprecedented Price Growth Amid Supply Constraints

Soaring Home Values in Las Vegas Fueled by Demand Outpacing Supply

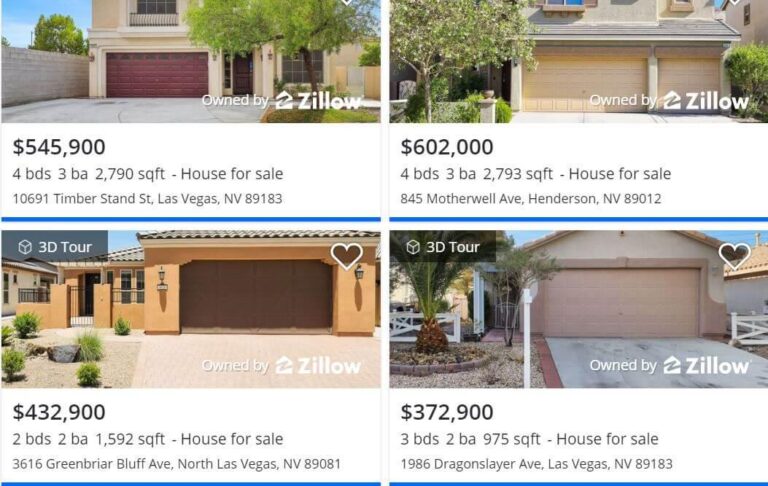

The Las Vegas real estate landscape is witnessing an unusual escalation in home prices as buyers face fierce competition for a limited number of available properties. Demand has reached record highs, driven by historically low mortgage interest rates and a steady influx of new residents drawn to the city’s expanding job market and appealing lifestyle. Despite this surge in buyer interest, housing inventory remains critically scarce, creating a seller’s market where bidding wars have become the norm. Experts caution that unless the supply of homes increases, affordability challenges will intensify for many prospective homeowners.

Several key elements are accelerating this rapid price growth:

- Slow pace of new construction: Labor shortages and supply chain disruptions have delayed the completion of new housing projects.

- Robust population influx: Nevada continues to be a top destination for domestic migrants seeking better economic opportunities.

- Investor purchases: A growing number of investors acquiring single-family homes reduces availability for owner-occupants.

The table below illustrates median home price changes across various Las Vegas neighborhoods over the past year, highlighting disparities in growth rates throughout the metropolitan area:

| Neighborhood | Median Price (2024) | Yearly Price Increase (%) |

|---|---|---|

| Summerlin | $485,000 | 18% |

| Henderson | $460,000 | 16% |

| North Las Vegas | $385,000 | 22% |

| Downtown Las Vegas | $425,000 | 19% |

National Housing Market Trends Reflect Similar Price Increases Amid Economic Recovery

The upward trajectory in home prices is not unique to Las Vegas; it is echoed across the United States as the housing market rebounds alongside the broader economy. Buyers nationwide are contending with limited housing stock, which, combined with low borrowing costs and a growing preference for suburban and exurban living, has driven prices to levels unseen in over a decade.This surge is underpinned by rising consumer confidence and improving employment rates, which together create a dynamic and competitive real estate environment.

Key drivers behind this nationwide price escalation include:

- Elevated buyer interest: Remote work adaptability and shifting demographics have expanded the pool of potential homeowners.

- Inventory shortages: Many current homeowners are reluctant to sell amid economic uncertainties, tightening supply.

- Government stimulus measures: Fiscal policies have encouraged investment in real estate and consumer spending.

The following table presents average price increases and inventory levels across major U.S. regions, illustrating the widespread nature of these trends:

| Region | Year-over-Year Price Growth | Months of Inventory Available |

|---|---|---|

| West Coast | 15% | 2.3 |

| Midwest | 10% | 3.0 |

| South | 13% | 1.9 |

| Northeast | 12% | 2.7 |

Challenges for First-Time Buyers and Affordable Housing Amid Rising Costs

The rapid escalation in home prices is creating significant obstacles for first-time buyers,particularly in Las Vegas. Higher mortgage rates coupled with inflated home values are forcing many potential buyers to postpone their homeownership goals or remain renters longer than anticipated. Analysts warn that without targeted policy interventions, the prospect of owning a home may become increasingly unattainable for younger generations and lower-income families.

Advocates for affordable housing emphasize that the scarcity of budget-friendly homes is exacerbating socioeconomic disparities within the city.Efforts to expand affordable housing options are hindered by rising construction expenses and limited availability of developable land. The table below outlines critical factors influencing housing affordability:

| Factor | Current Impact |

|---|---|

| Construction Material and Labor Costs | Increased by 27% year-over-year |

| Average Mortgage Interest Rate | 7.1%, highest level in 16 years |

| Affordable Housing Inventory | Declined by 18% compared to last year |

| Median Home Price | $460,000, a 32% rise from 2023 |

- Effect on first-time buyers: Increased financial barriers leading to prolonged renting periods

- Affordable housing supply: Diminishing availability and slower growth rates

- Policy implications: Necessity for subsidies, zoning reforms, and innovative construction methods

Effective Approaches for Buyers in a Competitive, High-Price Market

Navigating a real estate market characterized by rapidly rising prices requires buyers to employ thoughtful strategies to secure homes without overextending financially.Focusing on essential property features rather than luxury amenities can increase flexibility and improve success in competitive bidding scenarios. Obtaining mortgage pre-approval beforehand enhances a buyer’s credibility and often strengthens their negotiating position. Collaborating with seasoned real estate professionals who possess deep knowledge of local market dynamics can provide early access to listings and strategic pricing insights.

Timing is also crucial; buyers should closely monitor price trends within target neighborhoods and be prepared to act decisively. Employing creative offer tactics such as escalation clauses or accommodating sellers with flexible closing dates can differentiate bids in multiple-offer situations. The table below summarizes practical strategies for buyers facing a challenging market:

| Strategy | Advantage | Proposal |

|---|---|---|

| Mortgage Pre-Approval | Demonstrates financial readiness | Secure before property search |

| Waiving Home Inspection Contingency | Accelerates closing process | Use with caution and professional advice |

| Escalation Clause Inclusion | Automatically outbids competing offers | Set a clear maximum bid limit |

| Flexible Closing Dates | Appeals to seller preferences | Offer adaptable move-in timelines |

Final Thoughts: Addressing Affordability in a Rising Market

As home prices continue their upward climb in Las Vegas and nationwide,prospective buyers face mounting difficulties entering the housing market. Experts emphasize that without meaningful increases in housing supply and supportive economic policies, affordability will remain elusive for many. Collaborative efforts among policymakers, developers, and community stakeholders are essential to curb escalating costs and preserve the dream of homeownership for future generations.