Las Vegas Real Estate Market: Unprecedented Growth Amidst Supply Constraints

Explosive Growth in Las Vegas Housing Market Fueled by Demand and Scarcity

Las Vegas is rapidly becoming the epicenter of the U.S. housing boom, with property values escalating faster here than in any other metropolitan area. This year,the local real estate market has witnessed extraordinary expansion,propelled by a surge in buyer interest and a stark shortage of homes for sale. The imbalance between demand and supply has intensified competition among buyers, driving prices upward at record-breaking rates. Contributing factors include historically low mortgage interest rates and the rise of remote work, which have attracted many relocating from high-cost cities in search of more affordable living options.

Several critical elements are intensifying the limited housing inventory and accelerating price increases:

- Construction Delays: Ongoing supply chain disruptions and labor shortages have slowed new housing developments.

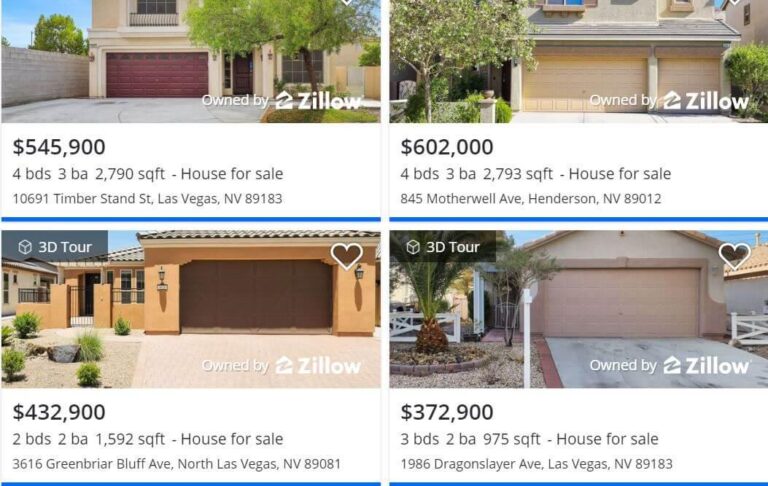

- Investor Purchases: Institutional investors acquiring large numbers of properties have further reduced availability for individual buyers.

- Population Influx: A steady migration from states like California has expanded demand beyond the current housing capacity.

| Indicator | Latest Figure | Annual Change |

|---|---|---|

| Median Home Price | $450,000 | +15% |

| Average Time on Market | 18 days | -12% |

| Active Listings | 1,200 | -25% |

Driving Forces Behind Las Vegas’s Rapid Home Price Appreciation

The surge in Las Vegas home prices stems from a complex interplay of market forces. A notable driver is the robust population growth, fueled by expanding employment opportunities in sectors such as technology, healthcare, and entertainment. This demographic expansion has sharply increased housing demand, outpacing the available supply in many neighborhoods.Additionally, mortgage rates averaging around 3.5% have made home financing more accessible, intensifying buyer competition. Meanwhile, investors targeting rental properties are capitalizing on the city’s strong rental market, further tightening inventory.

On the supply side,several challenges are constraining new construction. Rising costs for essential materials like lumber and steel, coupled with labor shortages amid economic recovery, have slowed building activity. Moreover, zoning laws and land-use restrictions in key areas have delayed development projects, limiting the influx of new homes. This combination has created a classic supply-demand imbalance, with demand far exceeding available housing stock. Key economic indicators illustrate these trends:

| Factor | Effect | Recent Data |

|---|---|---|

| Population Increase | Elevated Demand | +4.1% Year-over-Year |

| Mortgage Interest Rates | Enhanced Buyer Affordability | 3.5% Average |

| New Housing Permits | Restricted Supply Growth | -8% Year-over-Year |

- Diversified Economy: Attracts skilled professionals sustaining housing demand.

- Investor Influence: Drives up prices in both single-family and multi-family properties.

- Regulatory Constraints: Land-use policies limit expansion in key districts.

Challenges for Local Buyers and Shifts in Rental Market Trends

For many Las Vegas residents, escalating home prices have created significant barriers to homeownership, especially for first-time buyers. With median prices rising faster here than in any other U.S. city, affordability is becoming a critical issue. Consequently, a growing number of locals are opting to rent rather than buy, which has intensified demand in the rental market. This heightened demand has led landlords to increase rents, placing additional financial pressure on families and individuals aiming to establish roots in the area.

The rental sector is undergoing notable changes, including:

- Reduced Vacancy Rates: Rental properties are turning over quickly as more renters enter the market.

- Rent Growth: Average rents have climbed between 8% and 12% over the past six months, outpacing wage increases.

- Preference for Multi-Unit Housing: As single-family homes become less affordable, renters are increasingly choosing apartments and condos.

| Metric | 2019 | 2023 | Change |

|---|---|---|---|

| Median Home Price | $320,000 | $495,000 | +54.7% |

| Average Monthly Rent | $1,100 | $1,300 | +18.2% |

| Rental Vacancy Rate | 7.1% | 4.5% | -2.6 percentage points |

Strategic Advice for Buyers and Investors in a Competitive Market

Given the rapid escalation of home prices in Las Vegas, real estate professionals advise buyers and investors to adopt a well-informed and strategic approach. Conducting extensive market analysis and understanding neighborhood-specific trends can significantly enhance investment success. Prioritizing properties with strong resale potential, especially in areas slated for infrastructure improvements or commercial development, is recommended. Additionally,securing mortgage pre-approval before entering the market can provide a competitive edge in negotiations.

Investors are encouraged to diversify their holdings to mitigate risks associated with market fluctuations. Key considerations include:

- Cash Flow Analysis: Assess rental income potential and vacancy rates carefully.

- Long-Term Appreciation: Focus on neighborhoods with consistent past growth.

- Risk Preparedness: Maintain financial reserves to cover unexpected costs or vacancies.

| Approach | Advantage |

|---|---|

| Mortgage Pre-Approval | Enhances bargaining power |

| Neighborhood Research | Identifies areas with growth potential |

| Portfolio Diversification | Reduces exposure to market volatility |

Conclusion: Monitoring Las Vegas’s Housing Market Trajectory

As Las Vegas continues to lead the nation in home price growth,stakeholders remain vigilant in tracking the underlying factors shaping this dynamic market. While the surge in demand reflects confidence in the city’s economic vitality, affordability challenges persist for many residents. The coming months will be critical in observing how inventory availability, interest rate fluctuations, and local regulatory policies influence the future direction of Las Vegas’s real estate landscape.