Las Vegas Housing Market: Steady Price Growth Amid National Surge

Las Vegas Home Values Rise at a Controlled Rate Versus Nationwide Trends

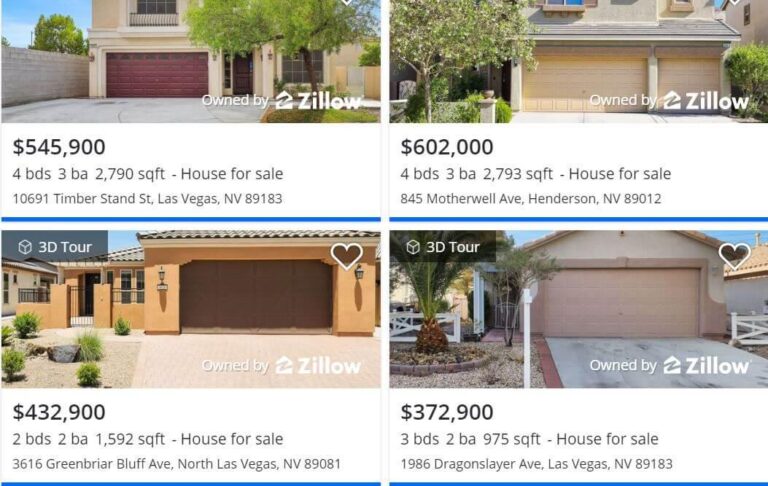

In recent months, Las Vegas has experienced a consistent yet moderate increase in residential property prices, diverging from the rapid escalation observed across many U.S. regions. This tempered growth is largely influenced by local market conditions, including a relatively higher availability of homes and more cautious buyer behavior compared to the national market frenzy. Such a trend points to a more balanced real estate environment, potentially attractive to both investors seeking stability and homebuyers aiming for affordability.

Several elements underpin this measured appreciation:

- Inventory Levels: A slight uptick in housing supply has helped prevent sharp price surges.

- Economic Factors: Employment and wage growth in Southern Nevada have improved steadily but without dramatic spikes.

- National Comparison: Across the country, limited housing stock combined with strong demand has driven prices upward more aggressively.

| Location | Yearly Price Increase | Median Home Price |

|---|---|---|

| Las Vegas | 4.3% | $405,000 |

| U.S. Average | 7.8% | $420,000 |

Key Drivers Behind Las Vegas’s Slower Home Price Growth

Multiple factors contribute to the more gradual rise in Las Vegas home prices compared to the broader U.S. market. Notably, the local economy has faced headwinds such as a deceleration in tourism revenue—a vital sector for the region—and the impact of climbing mortgage interest rates, which have dampened buyer enthusiasm. Additionally, the city is witnessing an increase in housing inventory, offering buyers more choices and alleviating upward price pressure, unlike many other markets still struggling with scarce supply.

Demographic shifts also play a role. Population growth in the area has slowed, and some prospective residents are reconsidering relocation plans due to rising living costs. Coupled with stricter lending criteria and escalating construction expenses, these factors contribute to a more stabilized housing market.The table below highlights a snapshot of relevant market indicators:

| Metric | Las Vegas | National Average |

|---|---|---|

| Year-over-Year Home Price Growth | 5.2% | 8.7% |

| Increase in Housing Inventory | 12% | 5% |

| 30-Year Fixed Mortgage Rate | 6.9% | 6.9% |

| Population Growth Rate | 1.1% | 1.5% |

How Market Trends Affect Buyers and Sellers in Las Vegas

For homebuyers in Las Vegas, the slower pace of price increases offers a welcome break from the rapid inflation seen elsewhere, providing more time to secure financing and evaluate options carefully. Conversely, sellers may face longer listing durations and less urgency from buyers, necessitating more strategic pricing and marketing approaches. This shift in market dynamics subtly rebalances negotiating power, frequently enough favoring buyers more than in overheated markets.

Meaningful considerations shaping these outcomes include the steady but cautious economic recovery,local job market conditions,and the current inventory levels.

- Buyers: Benefit from a less frenzied market,allowing thorough exploration of available properties.

- Sellers: Must adapt pricing strategies to remain competitive amid tempered demand.

- Real Estate Professionals: Serve as crucial intermediaries, managing expectations and facilitating balanced negotiations.

| Segment | Annual Price Growth | Average Days on Market |

|---|---|---|

| Las Vegas | 4.5% | 45 |

| U.S. National Average | 7.8% | 30 |

Strategies from Experts for Thriving in Las Vegas’s Changing Housing Market

Grasping the nuances of Las Vegas’s evolving real estate market is essential for both buyers and sellers. Industry specialists recommend focusing on localized trends, such as neighborhood-specific price movements and economic indicators like employment growth and new housing developments. While the national market may experience volatile price swings,Las Vegas’s steadier climb offers unique opportunities for negotiation and investment timing.

Key recommendations for market participants include:

- Capitalize on Market Stability: Use the slower price growth to negotiate favorable purchase terms.

- Secure Financing Early: Obtain mortgage pre-approval to strengthen offers in competitive scenarios.

- Stay Informed on Inventory: Monitor new listings and price changes to identify the best moments to buy or sell.

| Factor | Market Effect | Recommended Action |

|---|---|---|

| Employment Growth | Supports steady price appreciation | Focus on neighborhoods near expanding job centers |

| New Construction | Boosts housing supply, stabilizing prices | Consider emerging developments for value opportunities |

| Interest Rates | Influence borrowing costs and affordability | Lock in favorable rates promptly |

Final Thoughts on Las Vegas’s Housing Market Outlook

As the real estate landscape continues to shift, Las Vegas’s more gradual home price growth compared to the national average presents a complex but promising scenario. While affordability remains a challenge, the moderated pace may open doors for buyers and signal a market adapting to broader economic realities. Moving forward, close observation of these trends will be vital for homeowners, investors, and policymakers aiming to navigate and capitalize on the evolving Southern Nevada housing market.