U.S. Casinos Achieve Unprecedented Revenue Milestone in 2023

Record-Breaking Casino Revenues Reflect Strong Consumer Engagement

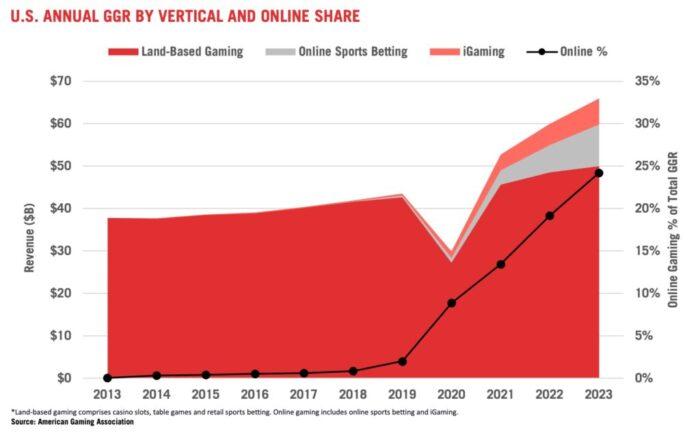

In 2023, the U.S. casino industry shattered previous records by generating an exceptional $66.5 billion in gambling revenue, marking the most lucrative year ever documented. This surge occurred despite ongoing economic challenges, illustrating the unwavering enthusiasm of American gamblers. Factors such as rising disposable incomes, the full reopening of entertainment venues, and a surge in foot traffic to physical casinos nationwide contributed significantly to this historic achievement.

Several pivotal elements fueled this growth, including:

- Increased participation from younger demographics engaging with both traditional and digital gaming platforms

- Growth of integrated resort complexes offering a blend of gaming, hospitality, and entertainment tailored to diverse tastes

- Innovative marketing strategies capitalizing on renewed consumer optimism and evolving leisure preferences post-pandemic

| Region | 2023 Revenue (Billion $) | Annual Growth Rate |

|---|---|---|

| Las Vegas | 15.2 | 8.4% |

| Atlantic City | 6.7 | 5.1% |

| Native American Casinos | 18.9 | 7.9% |

| Other States | 25.7 | 6.3% |

Gambling Industry Thrives Amid Inflation and Economic Uncertainty

Despite persistent inflationary pressures affecting many American households, the gambling sector demonstrated exceptional durability throughout 2023. Total casino revenues soared to an all-time high of $66.5 billion, signaling that economic concerns have not significantly curtailed consumer spending on gaming entertainment. Many patrons now regard gambling as a vital leisure activity rather than a discretionary expense. Analysts credit this trend to a blend of rising disposable income in select groups and the modernization of casino offerings that appeal to a broader audience.

Key drivers sustaining this momentum include:

- Broadened gaming selections: Launch of innovative games and expansion of digital platforms

- Revitalized tourism: Increased travel enthusiasm boosting visits to major gambling hubs like Las Vegas and Atlantic City

- Attractive promotions: Aggressive bonus and loyalty programs designed to maintain player engagement

- Demographic evolution: Younger generations adopting online and mobile gambling as mainstream entertainment

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|

| $15.9B | $16.4B | $17.1B | $16.7B |

These quarterly results illustrate a consistent upward trajectory, with casinos leveraging pent-up demand and innovative strategies to broaden their appeal across various demographics and economic segments. This adaptability has positioned the industry as a resilient economic force amid ongoing fiscal uncertainties.

Regional Markets and Gaming Categories Driving Industry Expansion

The surge in U.S. casino revenues during 2023 was propelled by strong performances across multiple geographic markets and a diverse array of gaming options. Established gambling centers such as Nevada and New Jersey maintained their dominance, while emerging states like Pennsylvania and Indiana experienced rapid growth by attracting new player bases and capitalizing on urban population increases and tourism rebounds post-pandemic.

Slot machines continue to be the primary revenue source, benefiting from technological advancements such as immersive themes and mobile integration that enhance player engagement. Table games, including blackjack and poker, attracted both high-stakes players and casual visitors, supported by enhanced in-house experiences and competitive promotions. Additionally, the expansion of sports betting and online gambling platforms significantly contributed to overall growth by offering convenient, accessible betting options that convert casual interest into sustained participation.

- Nevada: $12.5 billion in revenue, sustained by steady tourist inflows

- New Jersey: $8.3 billion in revenue, driven by a rapidly growing online gambling segment

- Pennsylvania: $6.1 billion in revenue, expanding market share through new venues and offerings

- Indiana: $3.7 billion in revenue, fueled by increased local investments and casino openings

| Gaming Category | 2023 Revenue (Billion $) | Year-over-Year Growth (%) |

|---|---|---|

| Slot Machines | 38.4 | 6.2 |

| Table Games | 15.7 | 4.8 |

| Sports Betting & Online Platforms | 12.4 | 15.3 |

Investment Approaches to Harness Growth in the U.S. Gambling Market

For investors aiming to capitalize on the flourishing U.S. gambling industry, diversification across high-growth sectors is essential. Online betting platforms, which continue to disrupt traditional casino models by attracting younger, digitally native audiences, present significant opportunities. Additionally, states newly legalizing gambling offer fertile ground for early market entry, enhancing regional revenue potential. Forming strategic alliances with technology firms and payment service providers can further boost returns by delivering seamless user experiences and secure transactions.

Recommended investment strategies include:

- Focusing on states undergoing or anticipating legalization reforms to secure first-mover advantages and capture emerging markets.

- Investing in hybrid casino-resort projects that integrate gaming with hospitality and entertainment to diversify income streams.

- Backing companies specializing in mobile and live dealer online gaming platforms, which are experiencing rapid user growth.

- Exploring ancillary sectors such as sports betting analytics and eSports wagering for complementary expansion opportunities.

| Investment Sector | Growth Outlook | Risk Profile |

|---|---|---|

| Online Gambling | High | Moderate |

| Land-Based Casinos | Moderate | Low |

| Sports Betting Analytics | High | High |

| Gaming Technology | High | Moderate |

Looking Ahead: Sustaining Momentum in a Dynamic Market

As the U.S. casino industry closes out its most profitable year on record, the $66.5 billion revenue milestone highlights a strong and persistent demand for gambling entertainment that remains largely unaffected by broader economic headwinds. This extraordinary growth not only reflects the sector’s resilience but also signals evolving consumer preferences amid ongoing financial uncertainties. Moving forward,industry analysts will closely monitor whether this upward trajectory represents a lasting shift or a temporary surge fueled by post-pandemic recovery and consumer optimism.