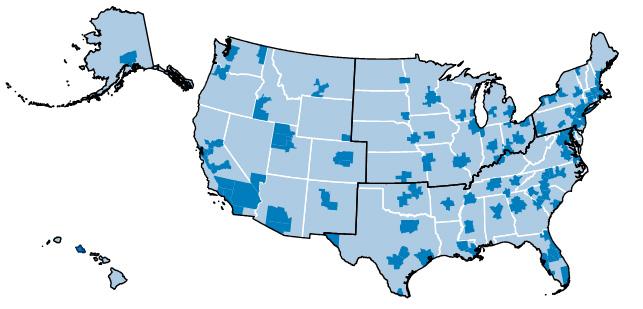

Top U.S. Metro Areas for Launching and Growing Startups in 2024

In today’s rapidly shifting economic environment, selecting the ideal city to establish a new business is as pivotal as the business concept itself. CNBC’s latest analysis spotlights the 20 leading metropolitan regions across the United States that provide the most fertile ground for entrepreneurs and startup ventures. This complete ranking assesses critical elements such as economic momentum, capital availability, talent pools, and the overall business ecosystem, equipping aspiring founders with essential insights. As competition intensifies, pinpointing where innovation and possibility flourish is vital for making strategic decisions on where to cultivate new enterprises.

Metro Areas Excelling in Startup Capital and Investor Networks

Securing funding remains a cornerstone for startup success, and certain metropolitan areas stand out for their vibrant investment landscapes. Customary powerhouses like the San Francisco Bay Area, New York City, and Boston continue to lead with extensive venture capital resources, active angel investor communities, and accelerator programs that nurture innovation. These cities not only offer abundant financial backing but also provide invaluable mentorship and networking platforms that help startups scale. Simultaneously occurring, emerging hubs such as Austin and Seattle are gaining traction by offering a blend of lower operational expenses and growing investor enthusiasm, attracting a diverse array of entrepreneurs and increasing deal activity.

Leading Cities for Startup Funding and Investment (2023 Data)

- San Francisco Bay Area: The global leader in venture capital, home to tech giants and disruptive startups.

- New York City: A financial center with a burgeoning tech venture ecosystem, merging finance and innovation.

- Boston: Known for biotech and advanced technology startups, supported by active investors and research institutions.

- Austin: Draws early-stage funding with a dynamic community and affordable costs.

- Seattle: Hosts major tech companies and a growing angel investor network fueling new enterprises.

| Metro Area | Venture Capital Raised (2023) | Active Investors | Dominant Sectors |

|---|---|---|---|

| San Francisco Bay Area | $60B | 850+ | Technology, SaaS, Biotechnology |

| New York City | $30B | 600+ | Fintech, Media, Healthcare |

| Boston | $15B | 400+ | Biotech, Clean Energy, Robotics |

| Austin | $5B | 250+ | Software, Consumer Technology |

| Seattle | $4B | 200+ | Cloud Computing, AI, E-commerce |

Cost-Effective Emerging Startup Cities

For entrepreneurs prioritizing affordability without sacrificing growth potential, several lesser-known cities are rapidly becoming attractive alternatives. These emerging hubs combine reasonable real estate prices with expanding technology sectors and supportive municipal policies, creating an inviting environment for startups to thrive without the financial strain typical of larger metros. Cities like Tulsa, Oklahoma, and Boise, Idaho, exemplify this trend, offering operational costs substantially below national averages while investing in infrastructure and workforce advancement.

Key advantages of these up-and-coming business centers include:

- Affordable Office Space: Rental rates frequently enough 30-40% lower than in major metropolitan areas.

- Incentive Programs: Tax breaks and grants designed to attract and retain startups.

- Accessible Talent: Lower living costs enhance labor market adaptability and availability.

- Improved Connectivity: Upgraded internet and transportation systems support business operations.

| Metro Area | Average Lease Cost (per sq ft) | Startups Founded (2023) | Local Incentives |

|---|---|---|---|

| Tulsa, OK | $18 | 1,200 | Tax credits and grants |

| Boise, ID | $22 | 950 | Business-amiable zoning laws |

| Greenville, SC | $20 | 800 | Workforce development programs |

| Des Moines, IA | $17 | 1,050 | Investment tax incentives |

Innovation Hotspots and Entrepreneurial Ecosystems

Several U.S. cities have carved out reputations as innovation powerhouses, fostering environments where startups can flourish through access to cutting-edge research, capital, and collaborative networks. These metros provide a fertile ground for transforming novel ideas into scalable businesses, attracting a diverse and skilled workforce eager to contribute to dynamic industries.

Integral to these ecosystems are accelerator programs, co-working spaces, and specialized incubators that offer tailored mentorship and funding pathways. Cities such as Austin,San Francisco,and Boston exemplify this synergy by encouraging partnerships among universities,investors,and government bodies,creating a robust support system for entrepreneurial ventures.

Key Innovation Catalysts in Leading Cities

- Venture Capital Access: Critical for early-stage growth and scaling operations.

- Research Collaborations: Partnerships with top academic institutions drive R&D.

- Networking Opportunities: Frequent industry events foster valuable connections.

- Skilled Talent Pools: Availability of professionals in technology, marketing, and management.

| City | Primary Industry Focus | Notable Startup Support Programs |

|---|---|---|

| Austin, TX | Software & Clean Technology | Capital Factory, MassChallenge |

| Boston, MA | Biotechnology & Healthcare | LabCentral, Greentown Labs |

| San Francisco, CA | FinTech & Artificial Intelligence | Y Combinator, 500 Startups |

| Denver, CO | Renewable Energy & Aerospace | Denver Startup Week, Techstars |

Regions with Strong Workforce and Business Support Infrastructure

Successful startups frequently enough emerge from metro areas that combine a deep talent reservoir with comprehensive business support services. Cities like Austin, TX, and Raleigh, NC, stand out due to their proximity to leading universities and vocational training centers, continuously supplying a skilled labor force aligned with evolving industry needs. Additionally, these regions benefit from innovation hubs and incubators that provide mentorship, networking, and capital access—critical components for early-stage business growth.

These metros also excel in integrating public and private sector initiatives aimed at streamlining entrepreneurial success. From simplified permitting processes to state-sponsored grants and local chambers of commerce offering customized advisory services, these cities create an enabling environment that extends beyond workforce availability.

| Metro Area | Workforce Strength | Business Support Highlights |

|---|---|---|

| Denver, CO | Technology-focused talent pool | Robust venture capital ecosystem |

| Atlanta, GA | Diverse professional workforce | Access to multiple business incubators |

| Minneapolis, MN | Experienced manufacturing labor | Innovative workforce training initiatives |

Conclusion: Navigating the Best U.S. Cities for Startup Success

CNBC’s evaluation of America’s top 20 metro areas for business creation highlights regions where economic vitality, supportive infrastructure, and dynamic entrepreneurial ecosystems intersect. For founders aiming to launch and expand their ventures, these cities offer strategic advantages through access to capital, skilled talent, and market opportunities. As the entrepreneurial landscape continues to evolve, these metropolitan areas remain at the forefront of fostering innovation and economic growth. Entrepreneurs seeking to identify promising locations for their next venture will find this guide invaluable in charting a path toward success.