Las Vegas Entertainment: A Beacon of Economic Stability Amid Federal Reserve Policies

Robust Entertainment Metrics Highlight Economic Strength in Las Vegas

Las Vegas continues to demonstrate remarkable economic resilience,with its entertainment sector thriving despite the Federal Reserve’s tighter monetary stance. Recent figures reveal that convention attendance, casino earnings, and hotel occupancy rates have not only rebounded but, in many cases, surpassed levels seen before the pandemic. This resilience underscores the city’s adaptability and its role as a key indicator of broader economic health. Noteworthy statistics include:

- Convention Attendance: Increased by 12% year-over-year, fueled largely by a surge in international visitors.

- Casino Revenue: Exceeded $1.2 billion in March, reflecting strong consumer spending habits.

- Hotel Occupancy: Maintained an average of 87%, signaling sustained demand amid the travel sector’s recovery.

These data points reinforce the notion that discretionary spending remains robust, even as interest rates rise. This trend supports the Federal Reserve’s goal of achieving a “soft landing” — slowing inflation without precipitating a recession — by showing that consumer confidence in key urban centers remains intact.

| Metric | Current Value | Year-over-Year Change |

|---|---|---|

| Convention Attendees | 1.8 Million | +12% |

| Casino Revenue | $1.2 Billion | +7% |

| Hotel Occupancy | 87% | +5% |

Consumer Spending Patterns in Las Vegas Reflect Growing Trust in Inflation Management

Often regarded as a microcosm of the U.S. economy, Las Vegas is exhibiting signs of renewed consumer optimism amid ongoing inflationary challenges. Data indicates that spending on non-essential goods and services is not only stabilizing but expanding across hospitality, entertainment, and retail sectors. This trend suggests that consumers are increasingly confident in the Federal Reserve’s efforts to tame inflation without triggering a downturn. Both residents and tourists are demonstrating a willingness to spend, betting on continued economic stability.

Highlighted consumer behaviors include:

- Higher expenditures on dining and gaming, supported by relatively low household debt and increased disposable income.

- Growth in luxury and electronics retail sales, signaling positive expectations for future income.

- Rising bookings for short-term accommodations, reflecting sustained travel enthusiasm.

| Sector | Q1 Spending Growth | Year-over-Year Change |

|---|---|---|

| Hospitality & Entertainment | +7.8% | +12.3% |

| Retail (Luxury & Electronics) | +5.4% | +9.1% |

| Travel & Accommodations | +6.2% | +10.7% |

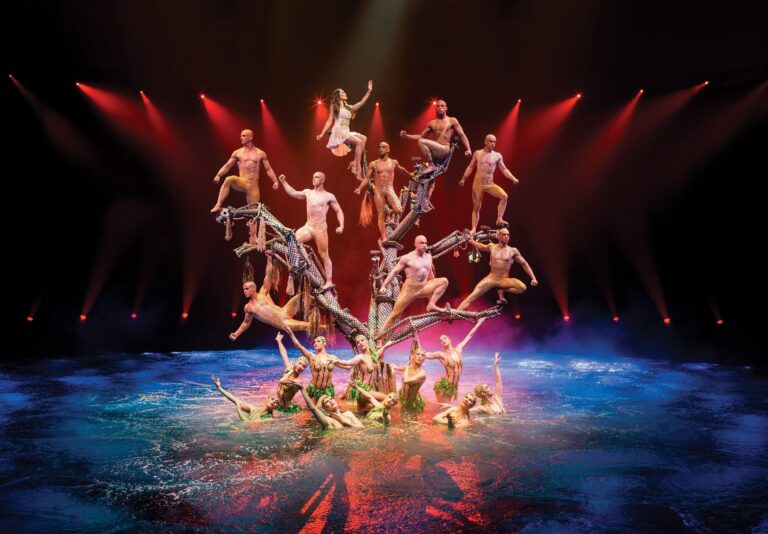

Industry Experts Link Las Vegas Show Revival to Federal Reserve’s Economic Strategy

The surge in Las Vegas show attendance and bookings offers compelling evidence that the Federal Reserve’s “soft landing” approach may be effective. Analysts attribute this revival to a combination of consumer optimism and sustained discretionary spending, even as the Fed carefully balances inflation control with economic growth. This positive shift contrasts with earlier forecasts predicting a sharp economic slowdown, illustrating the complex and varied effects of monetary policy on different sectors.

Contributing factors to this entertainment sector rebound include:

- Relatively stable interest rates encouraging borrowing and consumer expenditure.

- Fiscal policies aimed at boosting wages and employment levels.

- Renewed traveler confidence supported by the easing of pandemic-related restrictions.

| Metric | Pre-Fed Strategy | Current Status |

|---|---|---|

| Show Attendance | 65% capacity | Over 90% capacity |

| Average Ticket Price | $120 | $145 |

| Monthly Entertainment Revenue | $85 Million | Exceeds $130 Million |

Emerging Investment Prospects in Las Vegas’ Flourishing Entertainment Industry

The positive momentum in Las Vegas’ entertainment and hospitality sectors has attracted significant interest from investors and market watchers.Key economic indicators such as employment growth, tourism influx, and casino earnings point to a promising environment for sustained expansion. This resilience amid global economic uncertainties highlights Las Vegas as a fertile ground for long-term investment opportunities. The steady rise in discretionary spending and increased foot traffic in entertainment venues provide a solid foundation for growth across related industries.

Factors enhancing the investment climate include:

- Rising tourism demand: Visitor numbers are approaching pre-pandemic highs as travel restrictions continue to ease.

- Capital investments: Major resorts are announcing expansion and renovation projects, signaling confidence in future growth.

- Labor market improvements: Job growth in hospitality and retail sectors supports ongoing consumer spending.

- Economic diversification: Growth in technology startups and healthcare services complements the traditional entertainment economy.

| Indicator | Q1 2024 | Q4 2023 | Change |

|---|---|---|---|

| Tourism Arrivals (millions) | 5.4 | 5.1 | +5.9% |

| Casino Revenue (billion $) | 1.75 | 1.67 | +4.8% |

| Hospitality Job Growth (%) | 3.2 | 2.7 | +0.5% |

Looking Ahead: Las Vegas as a Harbinger of Economic Stability

As Las Vegas continues to captivate visitors with its vibrant entertainment offerings and bustling hospitality sector, it increasingly serves as a real-time indicator of the Federal Reserve’s success in managing economic growth. The city’s strong performance amid inflationary pressures and tighter monetary policy suggests that consumer confidence remains resilient. While economic uncertainties linger, the thriving activity along the Las Vegas Strip offers a hopeful outlook for investors and policymakers striving to navigate the complexities of today’s economic landscape.